10.28.22: Dow Jones Stocks Are Now Leading Markets Higher. Tech may catch up.

Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers: We believe markets are potentially set up for big moves in November and December. October has been friendly to Dow Jones investors, but less so for China, Semis, and Internet-Software stock investors.

We’ll continue to help our friends inside position themselves best as possible in this environment. Dow Jones stocks consist of roughly 15-18% of our Coverage Universe (We cover AAPL, MCD, V, and HD among a few others). The majority of our coverage is in Semis, China, FAAMG, U.S Internet. If these sectors, in addition to Dow Jones names, are areas you follow closely, let us help you understand when the tide will turn in (or out) of favor.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 3807.30

KWEB (Chinese Internet) ETF: $19.83

Analyst Team Note:

Despite the Fed’s effort of pushing out hawkish policies to fight inflation, prices still remain at high levels and consumers expect inflation to remain elevated over the next 12 months. Lots of talk about pivot but we reiterate our belief that there cannot possibly be a hard pivot when inflation stays high and GDP is growing more than expected…

Macro Chart In Focus

Analyst Team Note:

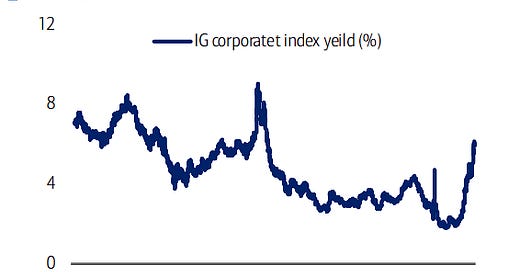

“Companies have already been shrinking their gross debt by about 1% YoY over the past six quarters. That was in part due to normalizing debt levels after borrowing heavily in 2020 to protect against the effects of the Covid pandemic. Going forward we expect IG issuers to continue reducing gross debt, this time to strengthen their balance sheets against a potential recession. On top of that borrowing costs are much higher as well, with IG index yield at the highest levels since 2009.” - Bank of America

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

The average American would have had to put in more than 64 hours of work in September to pay the typical monthly rent, the highest in data going back to 2015. However, rents and home prices are beginning to roll over.

Home prices are down over the last few months and Zillow is showing that rents are starting to fall in several major markets. The Zillow data tends to be a leading indicator for Owners’ Equivalent Rent (OER). Shelter inflation (~40% of core CPI) is one of the factors driving the Fed’s hawkishness and continued moderation in rents and home prices could be positive steps in slowing down inflation.

Chart That Caught Our Eye

Analyst Team Note:

“Valuations for Chinese growth stocks, which were egregious at a 115% overvaluation in 2020, are now 18% undervalued. In late 2015, they were 45% undervalued. They can also stay undervalued for years (such as from 2011 to 2015). But still, undervalued they are.” - BofA

Sentiment Check: We can’t help but ‘DCA’… Decade-old habits…

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs