10.26.22: FAAMG Earnings are (so far) reflecting macro weakness. This is not a surprise. No need to panic.

Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: Up until this point, we are witnessing the mega-cap names MSFT/GOOG/META experience softness post-earnings. Their share price reaction is not necessarily a surprise given the intense macro weakness that we’ve been discussing over the past several weeks and months now both publicly and privately. Secular winners can experience cyclical weakness.

In the meantime, the focus after this week’s FAAMG earnings will return to Macro. Remember to, at the minimum, think several weeks out about where markets will head next. Among Investor focus will be the energy situation globally and the coming U.S. Midterms elections, which are discussed in my newly released video just now.

Along with investment strategy, life perspectives are also provided - hopefully adding some humor to your day.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 3859.11

KWEB (Chinese Internet) ETF: $19.03

Analyst Team Note:

Last week, during which the S&P 500 was +4.7%, clients were net buyers of US equities for the sixth straight week, with inflows into both stocks and ETFs.

Buying was led by hedge fund clients; private clients were also buyers (for the fourth straight week). Institutional clients sold equities after buying for two weeks.

Corp. client buybacks have remained elevated and above typical seasonal trends since the start of Oct., suggesting corporates may be taking advantage of valuations amid the sell-off. YTD, client buybacks as a % of S&P 500 mkt. cap (0.19%) are above ’21 levels at this time (0.18%) but still below ‘19 levels at this time (0.30%).

Over the last three weeks, inflows into single stocks (as a % of S&P 500 mkt. cap) were in the 99th percentile of history since ’08 and two standard deviations above average, and still in the 92nd percentile excluding corp. client buybacks.

Data from Bank of America

Macro Chart In Focus

Analyst Team Note:

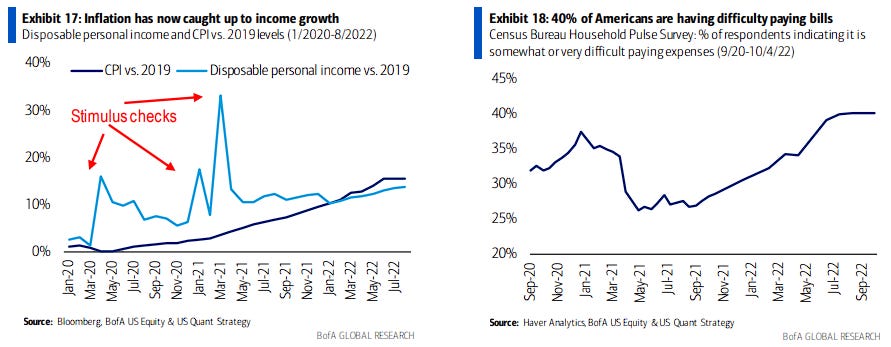

Consumers are getting squeezed. Disposable personal income is lagging inflation and 40% of Americans are having difficulty paying bills, above the 38% peak during the COVID pandemic…

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

N/A

Analyst Team Note:

Per The Information, Apple is cutting production of the iPhone 14 Plus less than two weeks after its debut. “Two downstream Apple suppliers in China that rely on the parts and assemble them into larger modules are also cutting their production 70% and 90% respectively”.

We’re in the early stages of demand destruction. Turns out, people don’t want to pay close to $1000 for marginal iPhone upgrades…

Chart That Caught Our Eye

Analyst Team Note:

“Companies have already been shrinking their gross debt by about 1% YoY over the past six quarters. That was in part due to normalizing debt levels after borrowing heavily in 2020 to protect against the effects of the Covid pandemic. Going forward we expect IG issuers to continue reducing gross debt, this time to strengthen their balance sheets against a potential recession. On top of that borrowing costs are much higher as well, with IG index yield at the highest levels since 2009.” - Bank of America

Sentiment Check: Close to Greed

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs

Strategist Larry’s Latest Tweets: