10.25.23: Markets Slide as Google Misses on Cloud Earnings

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Note from Tim Chang:

Alphabet (Google) shares dropped significantly after the company reported lower-than-expected profits in its cloud computing sector, raising concerns about its position in this crucial market.

Despite Google's dominance in search business, it has lagged behind competitors Amazon and Microsoft in cloud computing.

Although Google Cloud reported a profit for the first time earlier this year, its recent momentum fell short of expectations, widening the gap between Google and its rivals.

The company's shares fell as much as 8.9% following the announcement, marking the biggest decline since October 2022. This drop comes after a 57% gain in shares throughout the year, up until Tuesday's close.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4247.68

KWEB (Chinese Internet) ETF: $26.97

Analyst Team Note:

The S&P 500 Index has not reached a record high this year, and according to historical data compiled by Bloomberg, this could signal a strong rally in 2024.

The benchmark has typically gained an average of 10% in years following those without a record high, compared to just 4% after years with at least one peak.

Although there is no definitive correlation between record highs and index performance, a rally would be welcome news for the S&P 500, which has experienced three months of declines amid rising bond yields.

The index is currently 14% below its all-time high from January 2022 and has gone 454 trading days without a peak, the longest stretch since the global financial crisis.

With numerous risks looming, including an uncertain economic outlook, geopolitical tensions, and the possibility of a persistently hawkish Federal Reserve, a rally in 2024 would be a significant relief.

Macro Chart In Focus

Analyst Team Note:

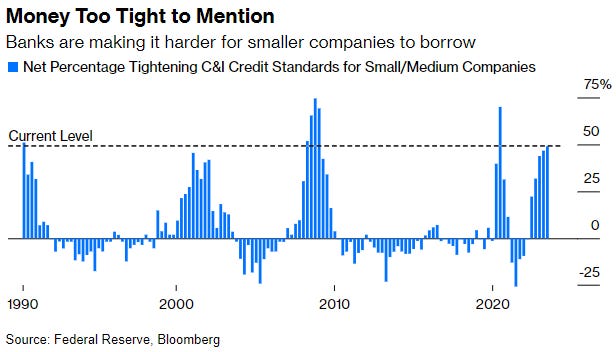

The Federal Reserve's survey indicates a tightening of standards for commercial loans, with almost 50% of banks making it harder for smaller companies to borrow, a level surpassed only during the pandemic and the Global Financial Crisis.

Many small companies are facing additional challenges due to a lack of profits, with a significant proportion being "zombie" companies that are loss-making.

Larger companies in the S&P 500 are also feeling the pressure, with debt repayments set to increase in the coming years.

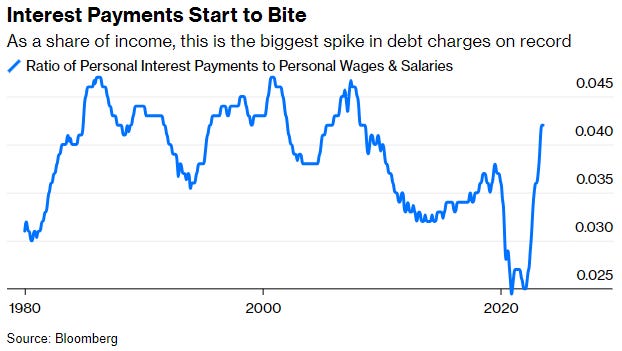

Furthermore, consumer debt is becoming a significant concern, as total interest payments have surged as a share of wages and salaries.

The cumulative effect of these factors could contribute to a credit crunch, especially given the 18-month lag typically associated with monetary policy effects, and it has been 18 months since the Fed began raising interest rates.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

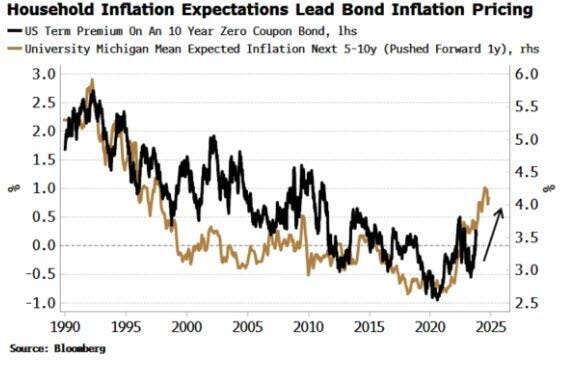

US bond yields are likely to increase further as retail investors become more focused on hedging against inflation, making any rallies in bonds temporary as the primary trend for Treasuries continues downward.

After the initial burst of US inflation in 2021, there was an increased interest in real assets and their proxies, such as commodities, and energy and industrial stocks, from both retail and professional investors.

Although this interest has waned somewhat, inflation is unlikely to return to a low and stable regime soon, with household flows into commodity ETFs and inflation-protected securities ETFs rising this year.

As households become the main buyers of US Treasuries, their long-term inflation expectations, which are higher than those of the Federal Reserve, will likely drive them to demand higher yields to compensate for the greater inflation risks they foresee.

Chart That Caught Our Eye

Analyst Team Note:

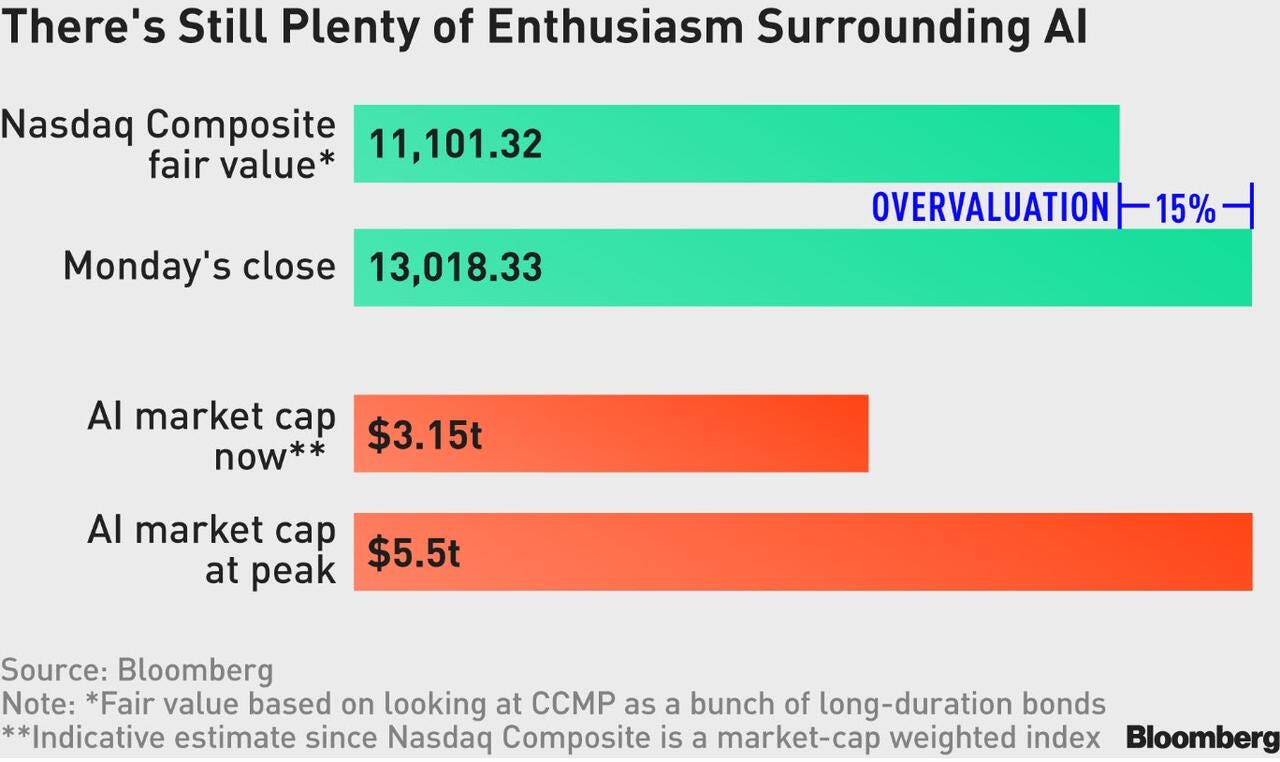

Investors are attributing a market value of over $3 trillion to the AI) industry, according to a Bloomberg analysis of the technology sector.

This valuation is based on the aggregate fair value of over 3,000 stocks in the Nasdaq Composite Index, which suggests that stocks are currently overvalued by 1,917 points, or roughly $3.1 trillion in market capitalization.

The analysis indicates that the overvaluation is largely due to investor enthusiasm for AI, which peaked in July, assigning a market capitalization of approximately $5.5 trillion to the AI complex.

However, this fervor has slightly diminished due to geopolitical tensions in the Middle East, and the market may see a correction if these tensions escalate, with technology stocks potentially surrendering the premium associated with AI.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.