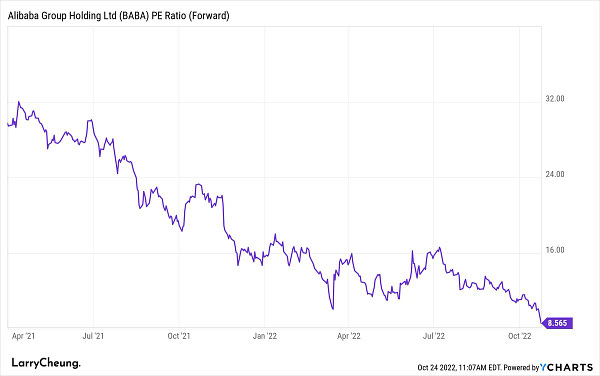

10.24.22: Sharp Divergence Forming between U.S. and China equities

Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: There is now a sharp divergence between U.S and China equities as the S&P 500 begins a recovery formation and China Internet Stocks breach 2022 lows. While most of my Public and Private Community is invested in both U.S. and China, I want to give some additional context on our core opinions shared in our Investment October Mid-Month update. In our Mid-Month update on October 16th, I published the following headlines inside our Investment Community…

On U.S. Equities (Oct 16th): Uncertain environment, but I see opportunity for the market to bounce significantly from today’s levels (SPX 3583 at time of publication).

On China Equities (Oct 16th): Covid Case count moderation can lead to tactical bounce but any rally has limits and will be on-watch (BABA 73/shr at time of publication. Experienced Small bounce to 75-77 before retracing all progress).

As you can see, our research shared has appropriately characterized the forward-looking environment since mid-October.

That said, this is indeed a very difficult time for all investors who have China related exposure (I am in this camp as well). As I’ve mentioned in the past, I can only control what I can control - and that is providing the highest quality and insightful research on U.S. and China equities. Stay strong my friends. I will do my best to help you navigate this chaotic environment. If you feel discomfort, understand that so do many other good people around the world. You are not alone. We are all in this together.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 3752.75

KWEB (Chinese Internet) ETF: $21.45

Analyst Team Note:

The Hang Seng China Enterprises Index is nearing 2008 levels as the party congress highlighted Xi’s unquestioned grip over the ruling party and a likely continuation of policies staked on Covid Zero and state-driven companies.

Macro Chart In Focus

Analyst Team Note:

“While the last four decades have seen credit spreads justifiably shrug off rising recessionary fears, we think the current episode is different… Higher policy rates and real yields will continue to bolster the value proposition of cash, pushing the credit risk premium higher.” - Goldman Sachs

Even though junk bonds are already offering attractive yield relative to the past few years, we could yields go even higher as spreads are still no where near historical highs.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

N/A

Analyst Team Note:

China’s export growth slowed in September, while imports remained weak as global demand cools.

Exports in US dollar terms expanded 5.7% last month from a year earlier, the General Administration of Customs said in a statement Monday. That was slower than the 7.1% growth in August, but beat the 4% rise forecast by economists in a Bloomberg survey.

Source: Bloomberg

Chart That Caught Our Eye

Analyst Team Note:

The collective central-banking pivot from stimulus to tightening is placing strains on governments and economies around the world. Soaring Treasury yields have also helped fuel dollar strength, driving currencies such as the yen to levels unseen against the dollar in over 30 years.

US Treasuries are on course for a 12-week streak of losses, the longest since 1984, when then-Fed Chairman Paul Volcker was carrying out a series of rapid rate hikes.

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs