10.23.23: Corporate Earnings Coming Above Estimates as Misses Underperform by Most in 4 Years

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Note from Tim Chang:

The S&P 500 swung between gains and losses after briefly breaching its key 4,200 mark — which represents a 50% retracement of the rally off the lows seen in the banking turmoil in March.

The VIX fell from a seven-month high.

Treasury 10-year yields dropped after touching 5% for the first time since 2007.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4224.16

KWEB (Chinese Internet) ETF: $25.64

Analyst Team Note:

Macro Chart In Focus

Analyst Team Note:

According to Bloomberg aggregate estimates, the US economy likely grew at its fastest pace in nearly two years during the third quarter, fueled by strong consumer spending despite the Federal Reserve's almost two-year-long cycle of interest rate hikes.

The median projection for GDP growth is 4.3% annualized for July-September, with personal consumption expected to advance at a 4% rate.

Inflation remains almost twice the Fed's target, and further evidence of above-trend growth or continued tightness in the labor market could prompt additional monetary policy tightening.

The September income and spending data, due to be released on Friday, will provide more insight into household demand and inflation ahead of the fourth quarter.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

The auto loan sector is facing a crisis, with the percentage of subprime auto borrowers at least 60 days past due on their loans reaching 6.11% in September, the highest rate since 1994, according to Fitch Ratings.

This increase in delinquencies is due to a combination of factors, including the Federal Reserve's aggressive interest rate hikes, elevated inflation, and the restarting of federal student loan payments, all of which have put immense pressure on consumers.

The situation is further exacerbated by the fact that consumers have been taking on more debt to fund car purchases in the face of record-high vehicle prices, resulting in monthly payments that often exceed $1,000.

The rising delinquencies are expected to lead to a significant increase in vehicle seizures, with Cox Automotive forecasting that 1.5 million vehicles will be seized in 2023, up from 1.2 million in 2022.

Chart That Caught Our Eye

Analyst Team Note:

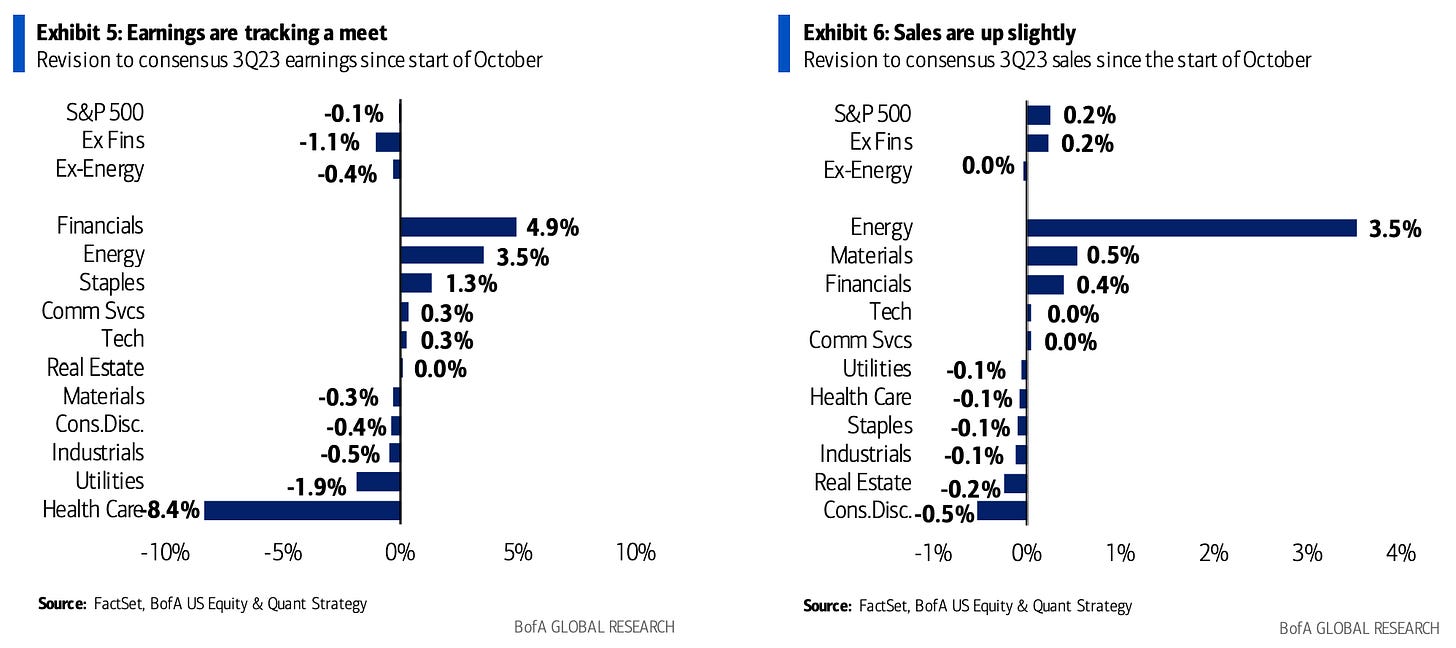

Companies in the S&P 500 that have reported earnings so far have faced negative reactions, with those missing earnings-per-share estimates underperforming the benchmark index by a median of 3.7%, the worst performance since data started being recorded in Q2 2019.

Surprisingly, even companies that beat estimates have trailed the S&P 500, underperforming by 0.6%, marking the first time this has occurred since Q4 2020.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.