10.2.23: Government shutdown avoided as markets shift back to inflation battle

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Note from Tim Chang: Washington DC’s deal over the weekend to avoid a government shutdown gave stocks only a brief respite as the focus in markets quickly shifted back to rates, especially as rising oil prices threaten to bring back inflation.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4288.05

KWEB (Chinese Internet) ETF: $27.37

Analyst Team Note:

Despite ongoing macroeconomic uncertainties, BofA’s Sell Side Indicator, a contrarian sentiment measure reflecting sell-side strategists' average recommended equity allocation in balanced funds, remained stable at 53.5% in September, unchanged since July and below the 60% benchmark allocation.

While the S&P 500 experienced approximately 20% growth since last September, the SSI is 11bps lower than a year ago. Currently in a "neutral" state, the SSI is considerably more bearish than bullish, with indicators suggesting a potential +15% price return for the S&P 500 over the next year, reaching around 4900.

Historically, when the SSI has been at or below its current level, the following 12-month returns on the S&P 500 have been positive 95% of the time, with a median return of 21%.

Macro Chart In Focus

Analyst Team Note:

Nearly 1,500 small businesses filed for Subchapter V bankruptcy this year through Sept. 28, nearly as many as in all of 2022, according to the American Bankruptcy Institute. Bankruptcy petitions are just one sign of financial stress. Small-business loan delinquencies and defaults have edged upward since June 2022 and are now above prepandemic averages, according to Equifax.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

N/A

Analyst Team Note:

According to Bank of America, it takes about a year for a drop in bank lending willingness to result in rising unemployment, which implies significant risk of a potentially meaningful increase in unemployment over the next year

Chart That Caught Our Eye

Analyst Team Note:

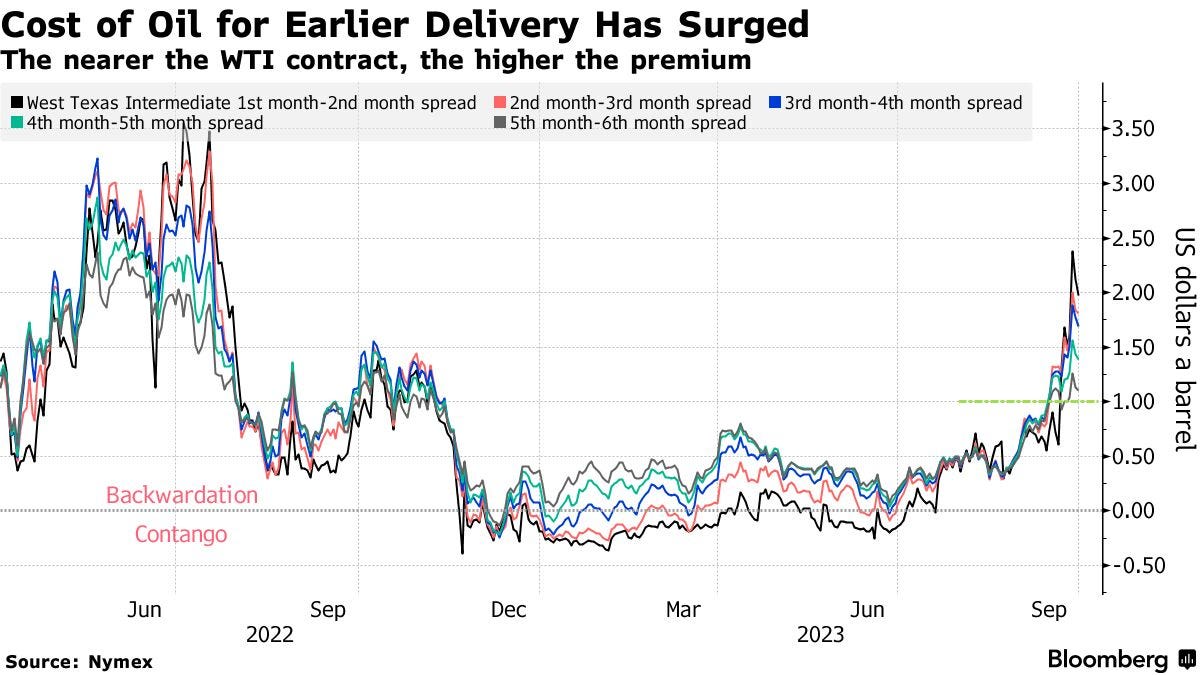

Oil has recently experienced its largest quarterly increase since early 2022, a surge driven by production cuts in Saudi Arabia and Russia coupled with record demand. This tightening in crude supplies has elevated the premium for West Texas Intermediate deliveries due in a month.

This scenario has led the market into a deeper state of backwardation, a term structure that shows ongoing concerns about inventory levels, prompting traders to place higher bids on nearer-term contracts.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.