10.21.22: We enter the Weekend with a sigh of relief (a pause in selling). Do not worry about Snapchat earnings. Other issues are more important than Snapchat.

Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: With the 20th Party Congress in China now in motion, I’ve provided an investment strategy update on the sector and the implications for key names in our coverage universe. In this report, we highlighted names within China that we believe would be affected more (or less) by Xi Jinping’s economic plans. If you are an investor in this space, our analysis will give you much more clarity in what I believe is a hard-to-read sector. There is a BIG difference between investing in Baidu/Tencent or say, Trip.com. Big difference. Our October report and this follow-up analysis discusses why.

As the U.S. market rebounds, it makes clear that our list of top ideas are starting to recovery more quickly than the market. We have continued to reiterate a list of Offensive and Defensive names that will likely prove its resilience. In this environment, our Defensive names are working better (not a surprise).

Along with time-tested index fund strategies, we urge our Public Community to also balance their portfolio strategy with more defensive names that also have growth characteristics. The indexes are still very heavily tilted towards growth-names. This will be OKAY if the Fed pauses rates soon. Remember that a strong Defense serves as a good Offense. We’d love to have you join us and leverage our research to help you gain clarity in a world filled with noise - thank you again for your support. I’m determined to help you get the best possible investment research in the most accessible way.

is email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 3665.78

KWEB (Chinese Internet) ETF: $21.34

Analyst Team Note:

“Holding bull market support for the 14-month RSI in the 45-41 range could mark the difference between a year-end into 2023 rally during the best part of Presidential Cycle and a deeper decline that calls into question the secular bull market from 2013.” - BofA

Macro In Focus

Analyst Team Note:

A recent Bloomberg piece caught our eye (“Three Hidden Words From Fed Insiders Point to Much Higher Rates”). The piece points out that the Fed Board staff has “revised down significantly” their estimate of potential Gross Domestic Product (GDP). Why does this matter?

The Board staff takes a conservative approach and would only make such a claim if they had strong evidence.

Lower potential GDP means the gap between GDP and potential is bigger, implying more overheating.

This adds to the case for more Fed rate hikes to bring GDP back down in line with potential

Source: Bloomberg, BofA

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

N/A

Analyst Team Note:

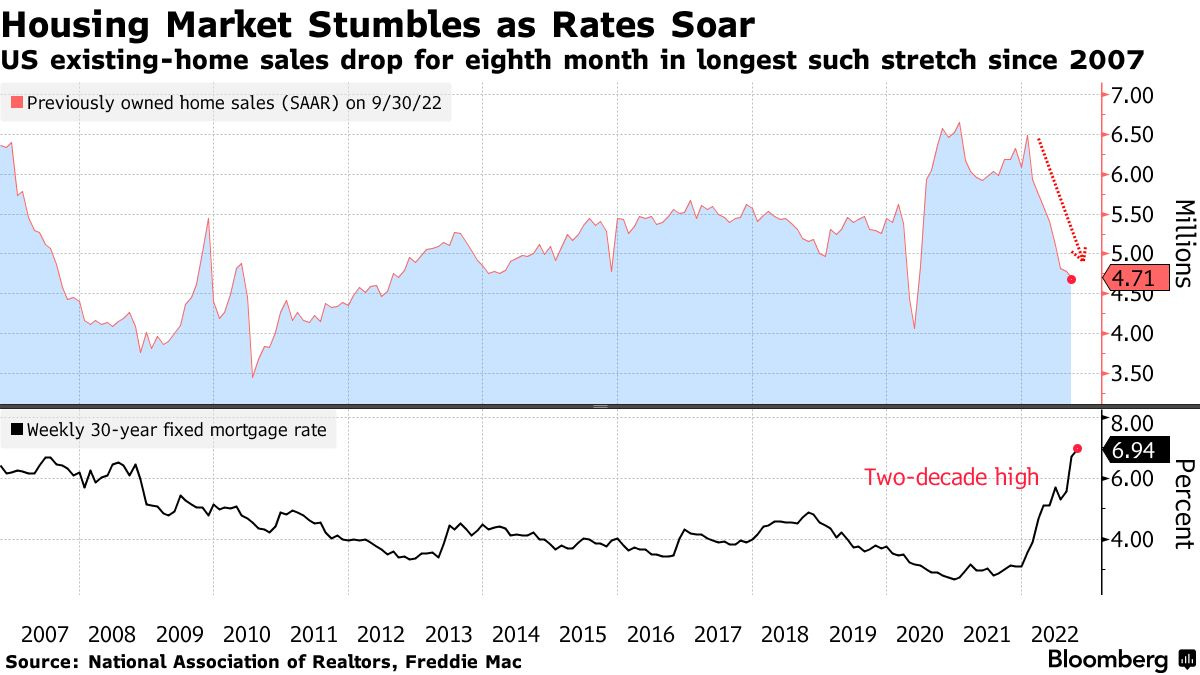

Sales of existing US homes fell for an eighth straight month in September, the longest stretch of monthly declines since 2007. Existing-home sales account for about 90% of US housing and new-home sales, which make up the remainder will be released next week.

Chart That Caught Our Eye

Analyst Team Note:

After bringing absolute chaos to the UK gilt market and pension funds, Liz Truss has resigned, making her the shortest-serving prime minister ever. At least she served under two monarchs…

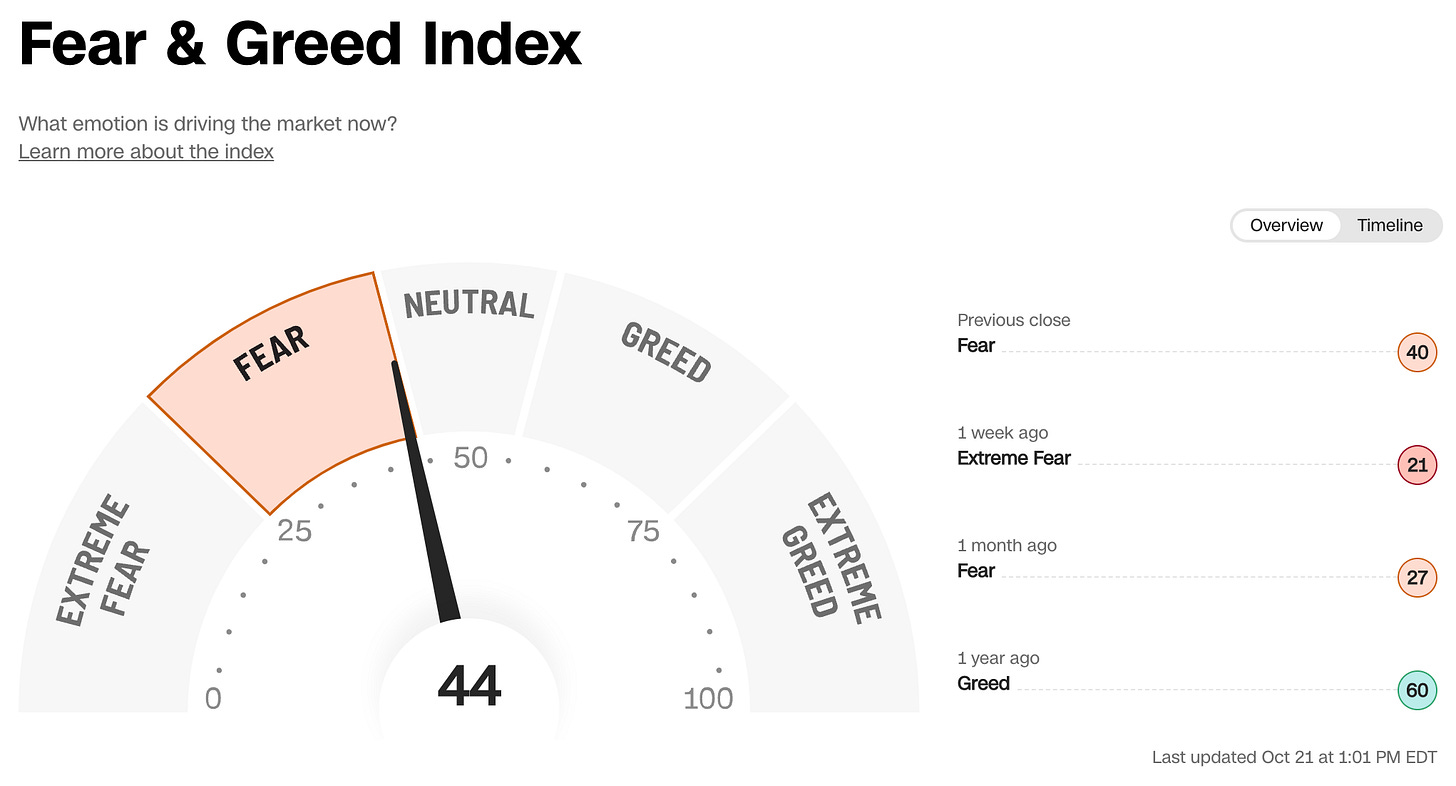

Sentiment Check: A tick from neutral…

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs

Word of affirmation from our Friends (our Aussie friends 🇦🇺 are about 7-8% of our Investment Community)

.