10.20.23: S&P 500 and Oil slides as Markets digest Powell's speech

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Note from Tim Chang: $122 billion. That's roughly how much market value Apple has lost over the last six trading sessions. Apple shares are set for their longest losing streak since January 2022.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4,278

KWEB (Chinese Internet) ETF: $26.11

Analyst Team Note:

Foreign money managers are exiting China's technology sector.

US and European fund managers have sold a net $1.6 billion of Chinese shares this month, following $3.5 billion of outflows in September.

Major tech companies such as Tencent, Alibaba, and JD.com have experienced the most significant selling.

Despite various stimulus measures from the government and improved economic data, China's stock market continues to struggle, with the CSI 300 index declining more than 4% this month and reaching an 11-month low.

Investor sentiment remains fragile, and foreign fund outflows are expected to continue unless there is a significant improvement in macroeconomic conditions, increased government stimulus, or additional market liquidity support.

Macro Chart In Focus

Analyst Team Note:

Despite the recent increase in economic activity, there is a significant risk that the Fed might not continue to raise interest rates.

Factors that could influence the Fed's decision include the possibility of receiving more soft inflation data or experiencing a slowdown in economic activity in the fourth quarter due to various factors such as higher rates, UAW strikes, a potential government shutdown, an increase in energy prices, and a leveling off in business investment.

Moreover, a government shutdown could disrupt the availability of data necessary for the Fed's decision-making process, potentially delaying further rate hikes until January.

Market trends already indicate that investors are considering the risks of a shutdown and the possibility that the Fed may require additional time to assess the economy's strength before deciding on further tightening.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

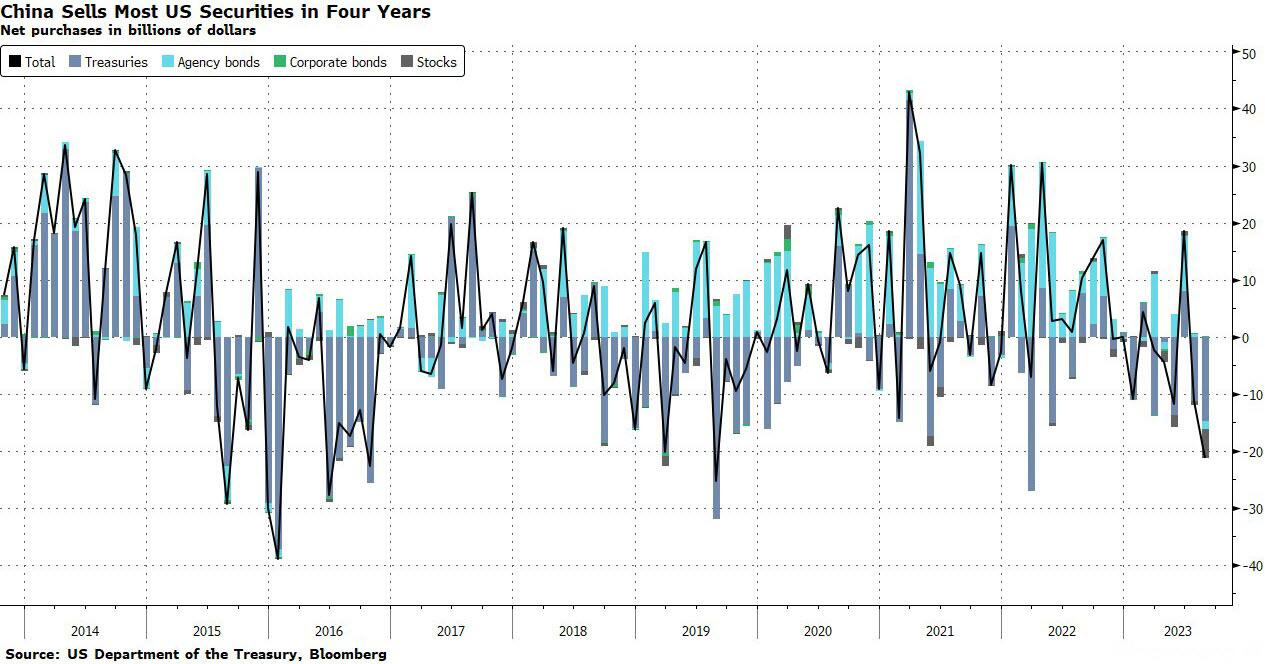

Chinese investors sold a significant amount of US bonds and stocks in August, marking the largest offload in four years.

This action has fueled speculation that Beijing is liquidating foreign exchange reserves to defend a weakening yuan, or potentially shifting away from US Treasury holdings in preparation for future geopolitical moves.

In addition to the $14.9 billion in US Treasuries sold, Chinese investors also sold a record $5.1 billion in US stocks.

The net sale of both types of bonds will likely raise concerns among investors tracking demand for US debt.

Meanwhile, Japanese investors have also reduced their holdings of US securities, with sales of corporate bonds reaching a record high.

Chart That Caught Our Eye

Analyst Team Note:

U.S. Treasuries are experiencing their worst drawdown in at least five years, with the Bloomberg Treasury Index down over 17% from its peak, and longer-duration Treasury debt experiencing a maximum drawdown approaching 50%.

When adjusting for inflation, the maximum drawdown of the dollar far exceeds that of other major assets, including the S&P 500.

This decline in the real value of the dollar is particularly detrimental for those holding Treasuries, as they are being paid back in a currency that is losing value in real terms.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.