10.19.22: Chinese Internet goes through intensive selling after a confluence of issues arise

Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers (Chinese Internet Investors) from Larry: My friends, this is a very difficult environment for Chinese Internet Investors (Alibaba, KWEB ETF, Tencent, Etc.). I have listened to and read the 20th Party Congress speech by Xi Jinping. The speech was nationalistic and I believe the rift between the U.S. and China will widen from here.

Because the Chinese Internet Stocks are traded on the U.S. Exchange, that places them in a special place of vulnerability. On top of current geopolitics, a recent flareup in Covid Cases has continued to depress investor confidence and sentiment.

I will continue to provide as best research as I can. As a reminder, I can only control what I can control: and that’s strong & insightful research. Despite my cautionary tone on China from my mid-October report, this recent wave of heavy selling is excruciating even for the strongest research analysts and investors. Just like many of you, I’m in the same positions. If you feel the heat, so do I. And so does everyone else with exposure.

Stay strong. Take a step back - although more pain may be in store, I ultimately believe that selling at low valuations such as these is not appropriate for long-term investors. If you are a member inside my Community, please feel free to message me directly 1:1 if you want to talk. My broad opinion continues to be to Strong Hold this sector.

My latest Youtube Video is out. I comment on China halfway through the video. Share the video with any friends/family invested in the sector. Comment your thoughts as well. Looking forward to seeing you in comments section.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 3719.98

KWEB (Chinese Internet) ETF: $22.55

Analyst Team Note:

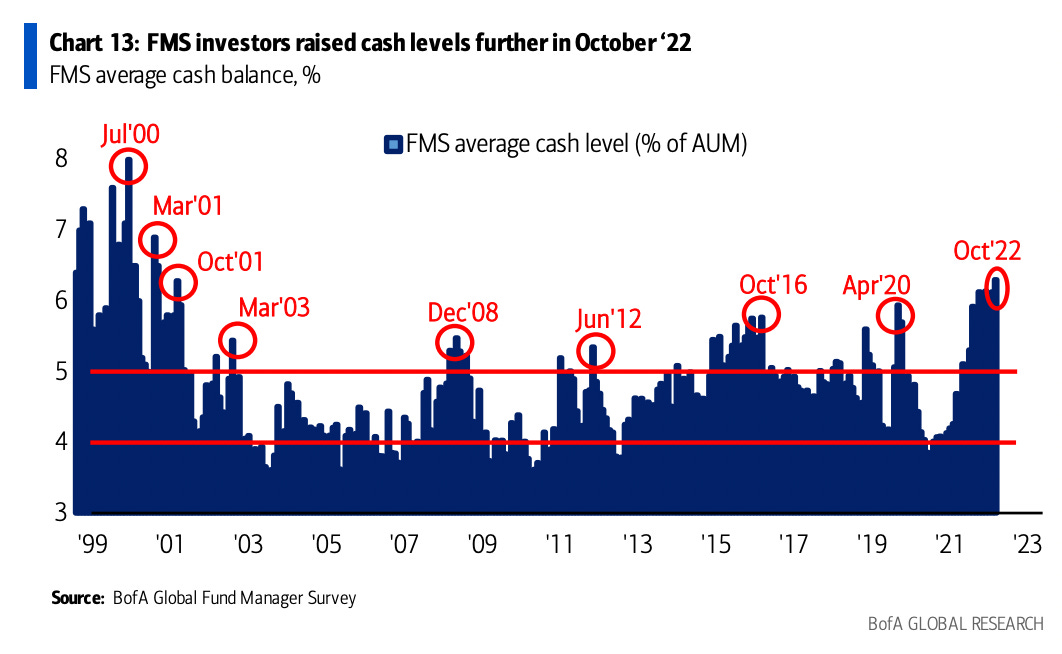

FMS investors increased average cash levels further in October ’22 to 6.3%, up from 6.1% last month and highest since April ’01 (still well above the long-term average of 4.8%).

Massive declines will be hard to come by because there’s a ton of money on the sidelines waiting for the fog to clear…

Macro Chart In Focus

Analyst Team Note:

BofA’s Fund Manager Survey (FMS) is always a gold mine of information…

“FMS expectations of lower short rates was 5% in March, now 28%, was 65% at prior “big lows”; most investors since Nov’08 expect lower bond yields next 4Qs but FMS says US PCE deflator <4% needed for Fed pivot.”

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

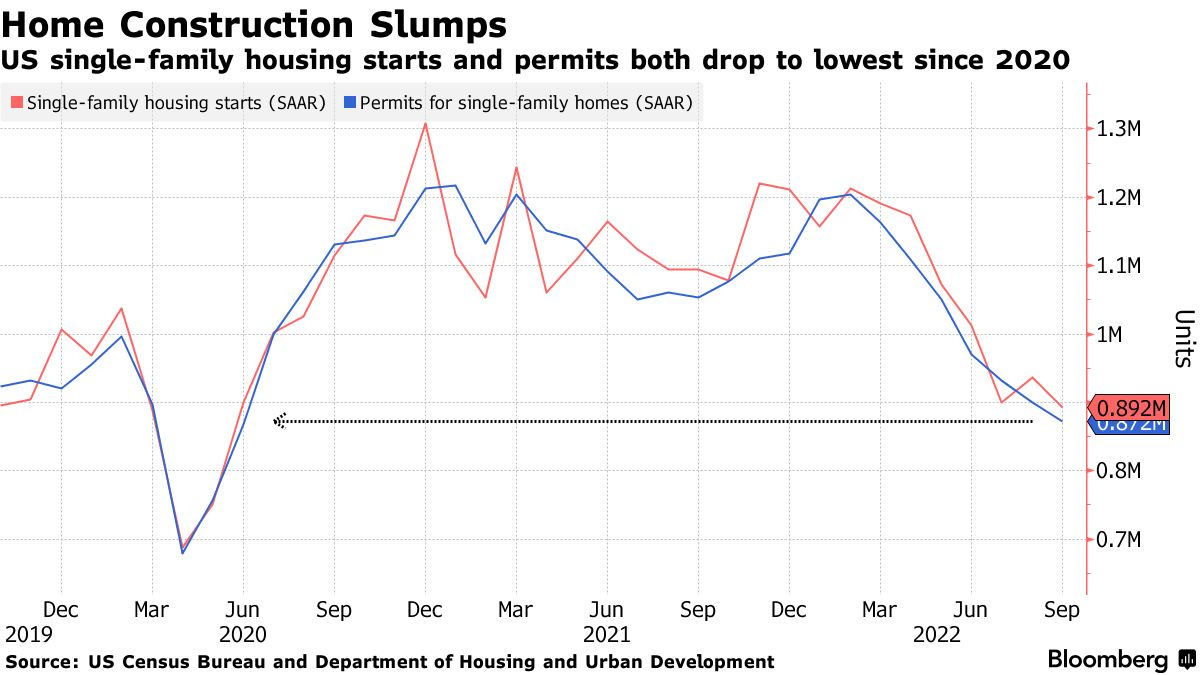

Residential starts decreased 8.1% last month to a 1.44 million annualized rate and single-family homebuilding dropped to an annualized 892,000 rate, the slowest since May 2020.

As mortgage rates approach 7%, we could see this trend continue.

Chart That Caught Our Eye

Analyst Team Note:

“The average yield at issuance for new speculative-grade bonds has soared to its highest level since the Global Financial Crisis, and is likely to remain in the double digits as borrowing costs continue to rise and investor appetite for risk wanes.

That leaves investors perfectly placed to demand higher yields and more concessions from those borrowers with no choice but to brave a decidedly hostile market.High-yield borrowers that tapped the market in October have paid an average all-in yield of 12.25%, according to LCD data — the highest since March 2009.” - PitchBook

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue hinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs