10.18.23: Stocks slip as Wall St concerns about US debt grows

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4373.20

KWEB (Chinese Internet) ETF: 27.10

Analyst Team Note:

After defending the low 4200s, the SPX has rallied, but resistance from 4375 to 4407 (9/21 downside gap and 50/100-day MAs) has provided a stubborn tactical barrier for the bulls.

The good news NYSE stocks scored an 80% up day on Monday and breadth stayed firm yesterday with a 70% up day.

That said, bullish follow-through on the SPX beyond resistance is still needed. Until then, 4335 to 4300 is key tactical support.

Macro Chart In Focus

Analyst Team Note:

The $10.6 trillion US corporate bond market, including high-quality debt from top-rated companies like Coca-Cola, Boeing, and Microsoft, is facing significant devaluation due to rising benchmark interest rates.

A representative portfolio by BondCliQ, which was worth $1 million in early 2022, has dropped to $612,863 in mark-to-market value, highlighting the distinction between credit risk and interest-rate risk.

As current bonds carry average coupons of around 3%, whereas new issues are priced at 6%, older bonds lose value.

While these bonds' principal remains secure, investors may experience reduced income and, if they choose to sell, potential losses.

This environment has led some investors to search for undervalued assets, with investment-grade bond yields surpassing the S&P 500's expected earnings yield for the first time since 2009.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

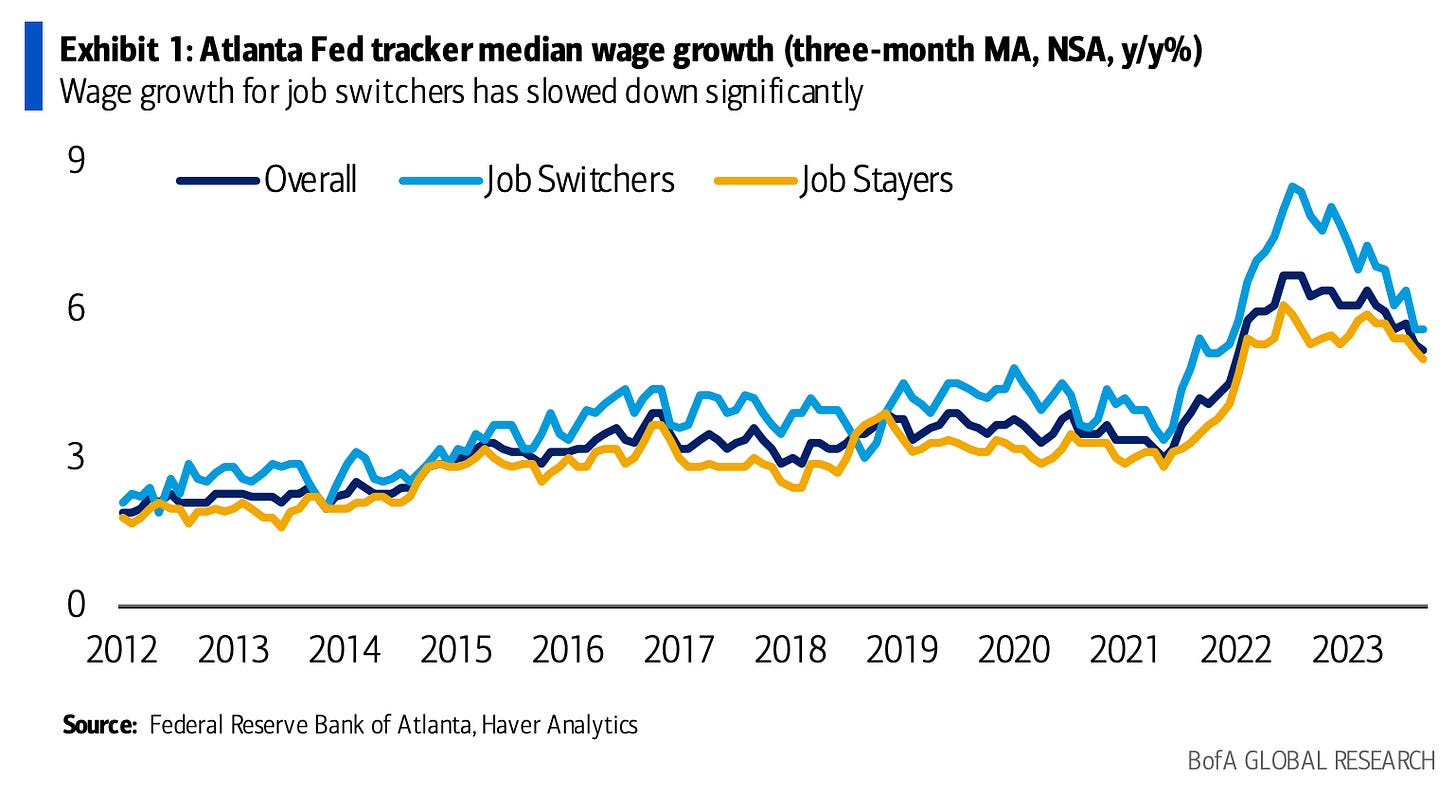

The Atlanta Fed's wage growth tracker data for September indicated a decline to 5.2% YoY, marking the lowest rate since January 2022 and pointing to subdued wage inflation amidst a stable labor market.

While average hourly earnings increased by 0.2% m/m in September, the annual rate slightly dropped to 4.2%. Wage inflation may decelerate further as wage growth for job switchers has notably reduced from 6.4% in July to 5.6% in September.

Additionally, the quits rate has descended to 2.3%, mirroring pre-pandemic levels, signifying fewer people transitioning to higher-paying roles.

Chart That Caught Our Eye

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.