10.17.22: We are actively studying China's 20th Party Congress and Its Implications for the China Internet Sector (Alibaba, KWEB ETF, Tencent, etc.)

Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers: We are actively studying the long-term plans of China’s 20th Party Congress and will let our Members inside our Investment Community know our opinions once we have enough information to share. Our Mid-Point October Report shared preliminary opinions ahead of this important event. We wish everyone a good start to the week as always.

In the meantime, we have shared our thinking on the U.S. Semis Export Ban on China in a popular Tweet. Feel free to follow us on Twitter for more updates. Link below.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe. Learn more about Interactive Brokers and their industry-beating margin rates and Hong Kong listed shares capabilities by clicking the link above.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 3583.07

KWEB (Chinese Internet) ETF: $21.65

Analyst Team Note:

“Following Week 1 [of Earnings], 36 S&P 500 companies comprising 10% of index earnings have reported. 3Q EPS estimates continued to slide last week, -1% to $54.83 (vs. our $55 and consensus $55.58), after a bigger-than-usual 7% cut heading into earnings . Just 42% of companies beat on both sales & EPS, below the historical post-Week 1 average of 47% and the weakest proportion since 1Q20.” - Bank of America

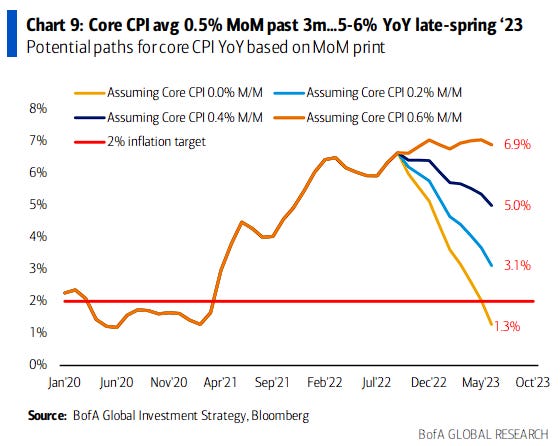

Macro Chart In Focus

Analyst Team Note:

Core CPI has averaged 0.5% MoM for the past 3 months. If sustained, core CPI would still be at 5-6% YoY in late-spring 2023…

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

China delayed the publication of gross domestic product data a day before the report was scheduled for release, a move likely to add to investor uncertainty.

The National Bureau of Statistics didn’t give a reason for the change, and provided no information about a new publication date.

The delay is likely due to the Communist Party’s congress this week.

Chart That Caught Our Eye

Analyst Team Note:

Last week, retail traders bought $19.9 billion worth of puts to open. They bought only $6.5 billion in calls to open. This is the first time in history that puts were 3x calls.

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs

Words of Affirmation from Inside our Community