10.16.23: Earnings season starts off positively as most surpass expectations

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Note from Tim Chang: Stocks rose and bonds fell amid diplomatic efforts to prevent the Israel-Hamas war from expanding into a regional conflict. Oil declined, following last week’s rally.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4327.78

KWEB (Chinese Internet) ETF: 27.28

Analyst Team Note:

Q3 earnings season has started off positively, with 32 S&P 500 companies reporting results that exceeded expectations by 9%.

This encompasses 11% of the S&P 500's earnings, with 3Q EPS indicating a 1% overall beat, primarily driven by banks.

So far, 81% of these companies have surpassed EPS predictions, 66% beat sales forecasts, and 53% exceeded both, outperforming the previous quarter and historical Week 1 averages.

Major banks like JPMorgan, Citigroup, and Wells Fargo surpassed both revenue and earnings expectations.

Notably, JPMorgan reported a record net interest income.

However, BlackRock experienced significant net inflows shortfalls, particularly with a $38B institutional net outflow, underscoring potential earnings risks for the financial sector due to persistent outflows from institutions.

Macro Chart In Focus

Analyst Team Note:

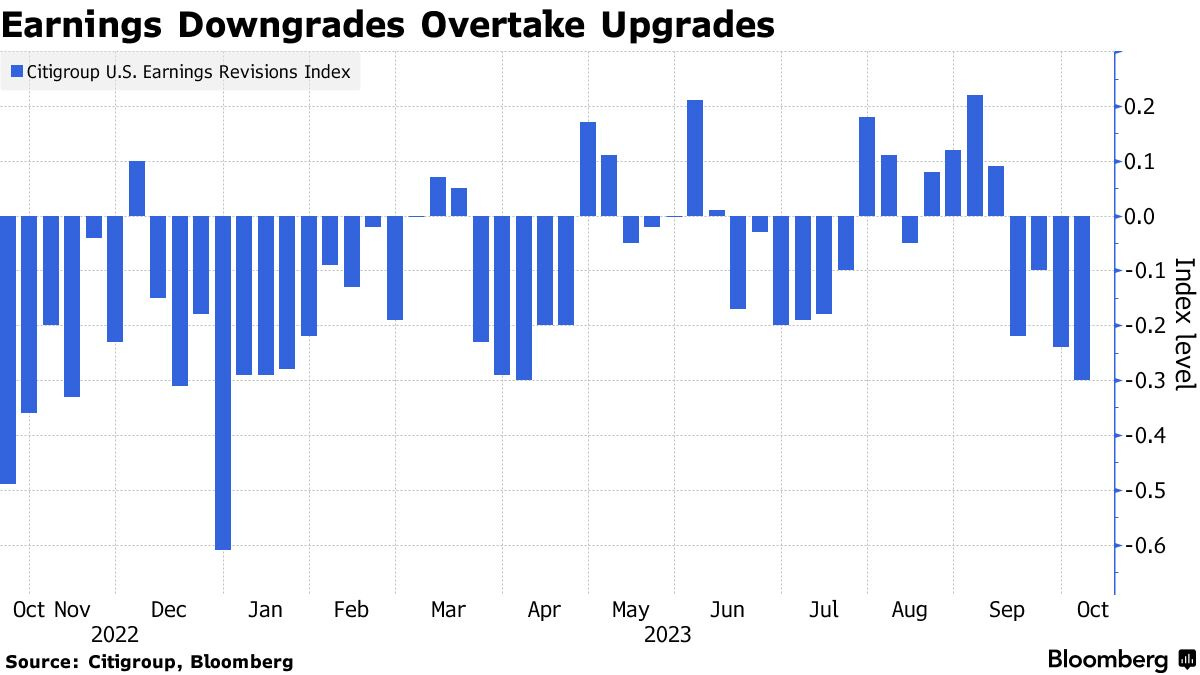

Strategists from major banks, including Morgan Stanley and JPMorgan, anticipate a weakening earnings outlook.

Despite the initial optimism, earnings revision breadth for the S&P 500 has decreased recently, with downgrades outnumbering upgrades.

Factors like higher interest rates and slowing consumer demand are expected to impact results.

However, early reporting season data shows a positive trend, with 88% of S&P 500 companies exceeding expectations.

RBC and Bank of America remain positive about the initial results, even though overall forecasts indicate a slight dip in third-quarter earnings before a year-end rebound.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

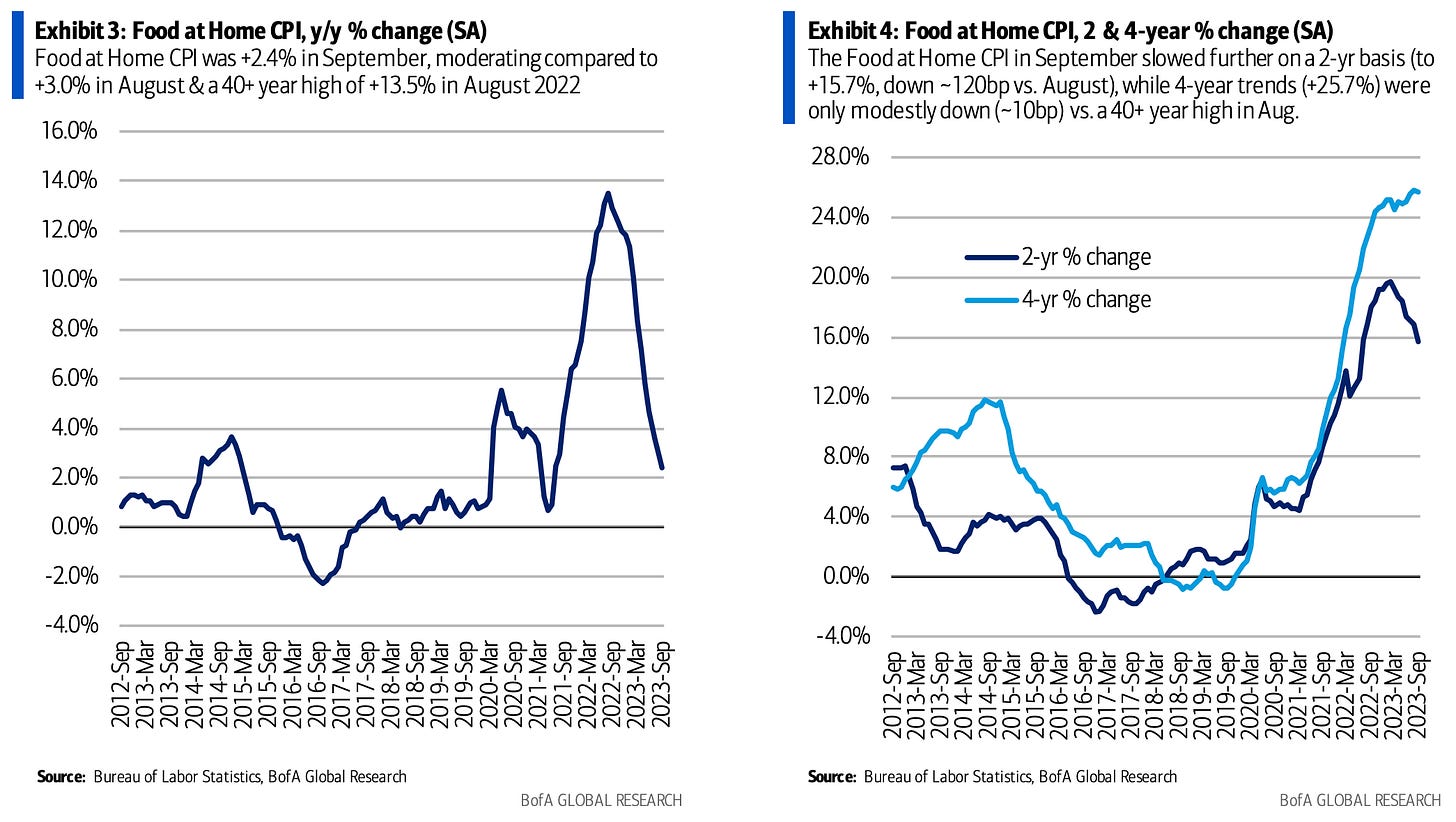

In September, “Food at Home” inflation rose by 2.4%, marking its 13th consecutive month of deceleration from a 40-year peak of 13.5% in August 2022.

Over a 2-year period, the inflation rate for Food at Home slowed to 15.7% from its February high of 19.7%. However, the 4-year trend persists near its 40-year pinnacle at 25.7%.

Chart That Caught Our Eye

Analyst Team Note:

US investment-grade corporate bond risk premiums currently stand at 1.24 percentage points, in-line with the past decade's average.

However, the financial environment has transitioned from easy to tight money, pushing financing costs to their highest since the financial crisis and raising corporate bankruptcies by around 40% this year.

Despite high corporate bond yields drawing in investors, some analysts believe that the market isn't adequately compensating for the risks, evidenced by significant underweight stances and increased short interest in major corporate debt ETFs.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.