10.14.22: Tremendous Warning Was Issued by Us in Semis this past week after U.S. Export Ban

Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: This investing environment is no doubt one of the most challenging periods for long-only investors that we’ve witnessed in a long time. Due to our extensive coverage of certain themes in the market (Semis, China Internet, U.S. Tech, Consumers), we understand when additional danger is arriving in the market.

We proactively immediately issued a warning for risk-reduction on Semiconductors on Monday October 10th and this strategy note helped our Community to stay away from starting new positions in Semis (even though valuations in our view are beginning to look handsome) and even take any opportunity to reduce exposure into any rally. We also provided guidance on the U.S. Export Ban’s likely implications on China Internet (KWEB ETF Components) and China EV.

Once again, this market will allow only the most prepared folks to reap the rewards of the eventual bull market. There will be a group of extremely patient investors who have the right Strategists and Researchers by their side to help them to add/re-enter at the most thoughtful and careful moments. We will do everything we can to put you in this camp.

We want you to be aware of the most important and critical risks that are looming, and will proactively help you assess the landscape with the highest quality strategy in the most accessible way.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: $365.97

KWEB (Chinese Internet) ETF:

Analyst Team Note:

Should we listen to fundamentals or technical analysis?

Macro Chart In Focus

Analyst Team Note:

Looking back, everything screamed “market bubble”. Alas, hindsight is 20/20…

“As capital markets adjust to a new era of central bank stinginess relative to the last two and-a-half years, fading public sector spending suggests added risk to the downside over the near-term. As a formidable headwind, financial conditions are likely to remain under pressure given the combination of contracting money growth and weaker nominal growth. Against this backdrop, we believe that tightening monetary policy will continue to pressure the riskier areas of the market.” - Bank of America

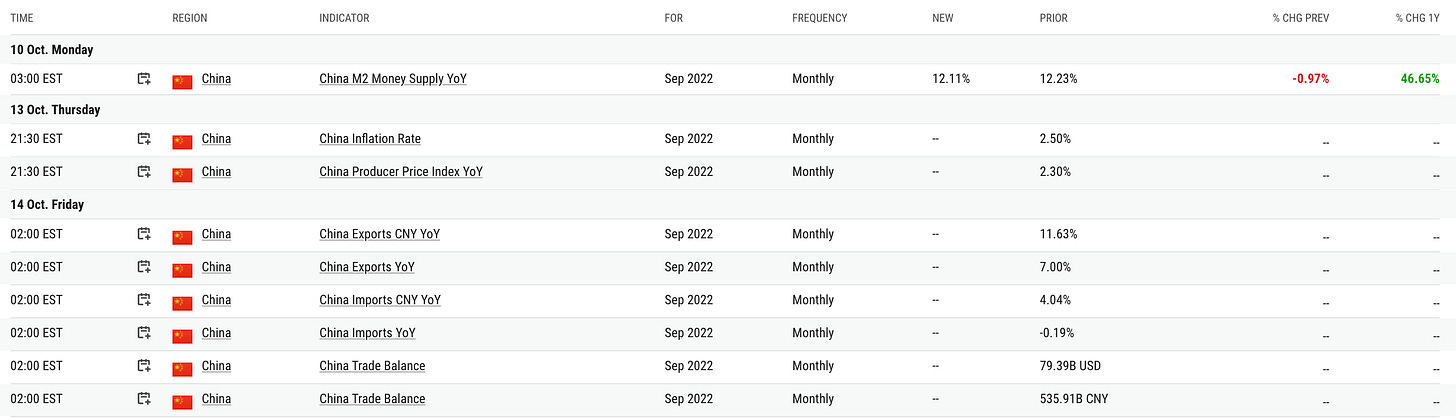

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

Inflation stays hot. In fact, it’s still rising. The cost of shelter and food (arguably the most relevant components of CPI) has continued to go higher.

“The September CPI print is not good -- and even so, the subdued monthly headline rate likely marks the best inflation news we’ll get for a while. With gasoline prices rising again since OPEC+ announced cuts, and core services inflation still robust, the upside surprise in today’s print -- plus the unfavorable prints expected in coming months -- will make it difficult for the Fed to communicate a downshift in the pace of rate hikes in December, as policy makers indicated in the latest dot plot.” - Bloomberg Economics

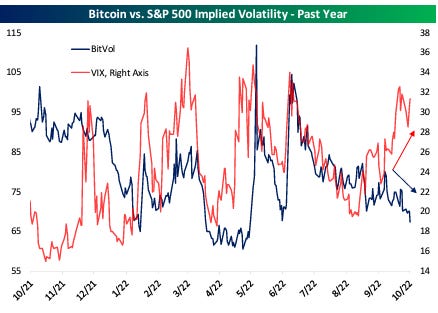

Chart That Caught Our Eye

Analyst Team Note:

Bitcoin has lower volatility than the S&P 500, but what does this mean?

Bitcoin’s trading volume has dramatically declined. Daily readings are hovering around $47 billion right now, down from more than $100 billion at the start of the year, according to CoinMarketCap.com.

“Low volatility in Bitcoin might not necessarily be a good thing, especially if it’s on low volume. So while low volatility is perhaps an indication that Bitcoin is becoming more boring and less contrarian, low volatility on low volume might not be great for Bitcoin.” - ARK Invest

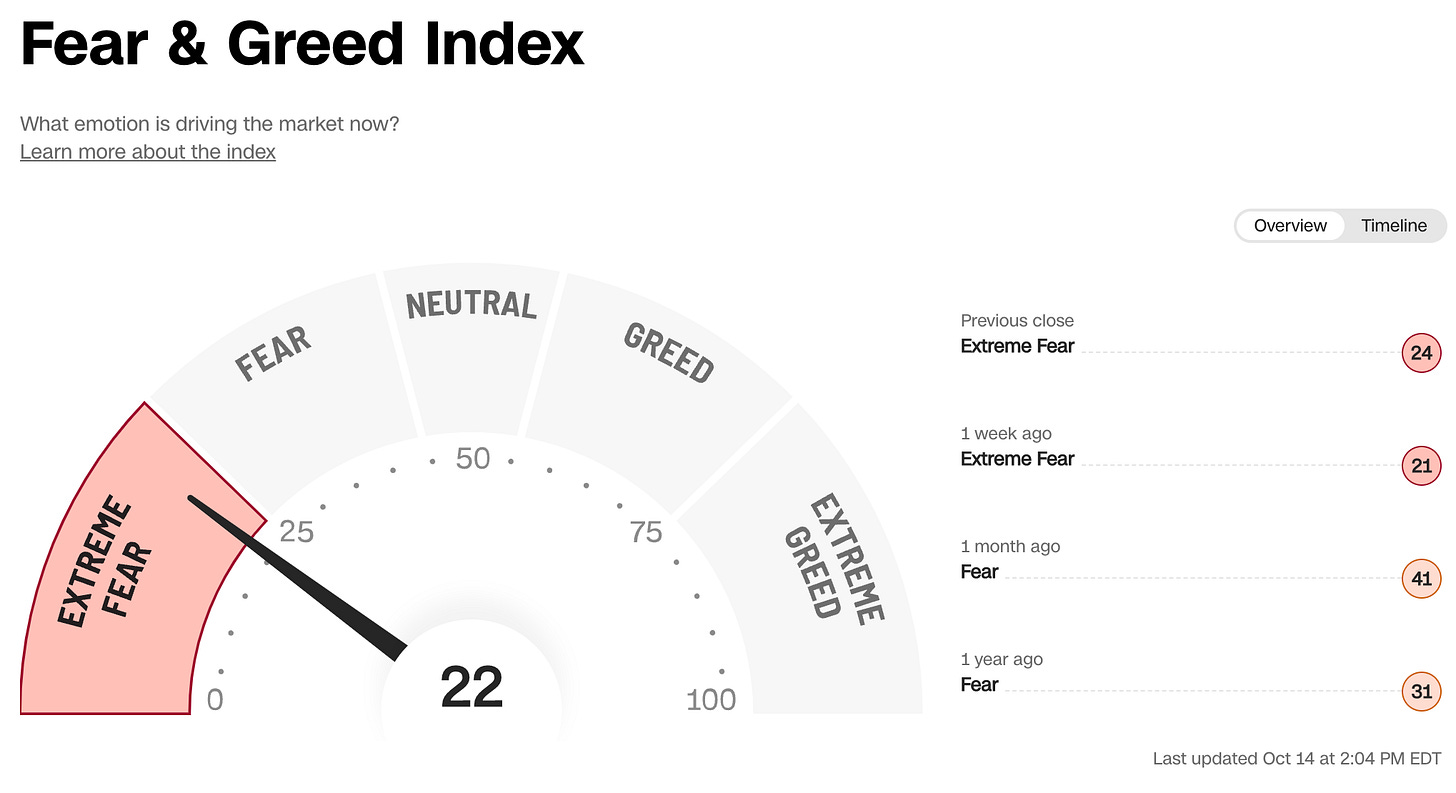

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs

Follow Strategist Larry on Twitter and Instagram for further commentary