10.12.22: We believe the Auto Component within CPI will be lower either immediately or in upcoming months.

Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: Tomorrow is the all-important September CPI release date. While we will of course provide an analysis of the official print after it’s released to our Investment Community in our Mid-Month Update, we also want to share our opinion on a PREVIEW into what CPI may look like by diving into the Auto (New/Used) Cars Market (which comprises of 9% weight in the CPI index).

I purposely made my newly released video very short/concise so that you can quickly get all the most valuable data/insights on the Auto Component of CPI. We’ll have follow ups on this topic on Twitter and Instagram.

This weekend, I will be releasing my Mid-Month update for October on Sunday October 16th. The strategy note will discuss where markets are likely head next after the September CPI inflation report. My Community is best for intermediate-term/long-term investors who have a strong interest in the S&P 500, the Chinese Internet Sector, U.S. Technology & Consumer names.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index:

KWEB (Chinese Internet) ETF:

Analyst Team Note:

Some quotes today from Neel Kashkari, the Minneapolis Fed President…

“If the economy entered a steep downturn, we could always stop what we’re doing. We could always -- if we needed to -- reverse what we’re doing, if we thought that inflation was headed back down very, very quickly”

“For me, the bar for such a change is very high because we have not yet seen much evidence that the underlying inflation -- the services inflation, the wage inflation, the labor market -- that is yet softening”

“I think a much more likely scenario is we will raise to some level north of 4% -- maybe 4.5 -- and then pause and sit there for an extended period of time while the tightening we’ve already done works its way through the economy”

Macro Chart In Focus

Analyst Team Note:

Even though loan distress has ticked up, we're still not seeing the distress from 2008, 2020, or even 2016. This could mean that the current environment is not tight enough and that the Fed needs to tighten further.

“Peak bearishness is needed to reach a cathartic moment within any market. In ours, we seem to need more time (and more data) to get there.” - BofA

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

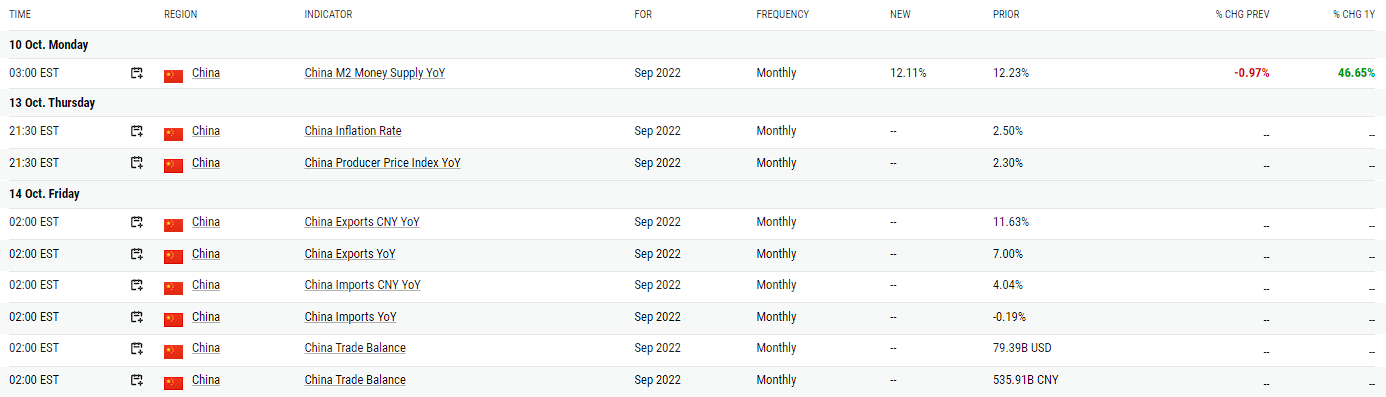

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

Headline PPI printed +8.5% YoY (which was hotter than the expected +8.4% YoY) but down from August's 8.7% (jumping 0.4% MoM after 2 straight months lower)...

A major factor in the September increase in prices for final demand goods was a 15.7-percent increase in the index for fresh and dry vegetables.

Food cost inflation is still up a stunning 11.90% YoY...

Chart That Caught Our Eye

Analyst Team Note:

“One fair value calculation for US 10-year bonds 1) adjusts the current yield by trailing 3- year annualized inflation; and 2) factors in the 3-month/10-year treasury curve. These inputs show where bond yields are relative to inflation and the compensation that an investor receives for owning longer-dated government bonds.

Today, this measure sits between -0.5% and -1%, signaling the most expensive bond market in 70 years (Exhibit 21). Historically, the measure has averaged around 2%, and we would wait to enter the market until levels aligned with historical norms.” - BofA

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs

Follow Strategist Larry on Twitter and Instagram for More Frequent Strategy Content