10.11.23: Fed minutes imply no rate hike in November

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4358.24

KWEB (Chinese Internet) ETF: $28.51

Analyst Team Note:

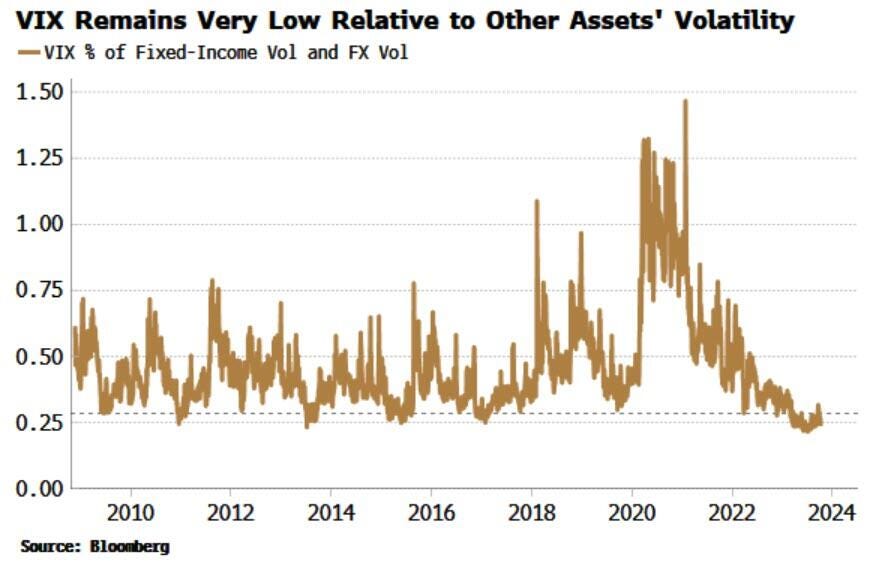

While the MOVE (fixed-income vol) and the CVIX (FX vol) are both notably above where they were in late 2019, the VIX is barely higher than its level just prior to the beginning of the pandemic.

Macro Chart In Focus

Analyst Team Note:

Major US banks, including JPMorgan , Citigroup, Wells Fargo, and Bank of America, are expected to write off approximately $5.3 billion in bad loans in the third quarter, marking the highest level of net charge-offs since Q2 2020, according to Bloomberg data.

While most consumers have managed to cope with the rate increases, banks are observing signs of financial weakness, especially among low credit score holders, amidst inflation eroding savings. This trend of deteriorating credit quality might compel banks to allocate more funds for loan loss provisions, consequently impacting their earnings.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

Here are key takeaways from minutes of the Federal Reserve's Sept. 19-20 meeting, released Wednesday:

All Fed policymakers agreed that the central bank should “proceed carefully” on rate decisions, and incoming data would help determine whether another hike was needed in coming months; language suggests Fed keeping door open to holding borrowing costs steady again at next decision on Nov. 1

All officials also agreed that rates should stay high for “some time” to keep bringing down inflation, with “several” policymakers seeking to shift focus of decisions and communications toward how long to keep rates high, rather than how high to raise rates

While officials stressed inflation remained too high, sentiment shifted further toward judging risks as “two sided” -- such as either too-high inflation or too-weak employment

“Almost all” officials supported the decision to hold the benchmark rate in a 5.25%-5.5% target range, indicating the broader 19-member Federal Open Market Committee wasn't unanimous, compared with the 12-0 decision among voting members

Chart That Caught Our Eye

Analyst Team Note:

The repercussions of nearly 15 years of near-zero interest policies have led to a surge in aggregate debt levels across public and private sectors.

Since the 2008/2009 Global Financial Crisis, encouraged by record-low borrowing costs, IG corporates have substantially increased their debt, with the total notional debt outstanding growing from $1.9 trillion at the end of 2006 to $8.6 trillion, reflecting a 10% CAGR and outpacing the growth of the U.S. GDP.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.