10.10.22: Earnings Season Begins. Can S&P 500 corporate earnings defend the Bulls?

Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers: We are disappointed to see U.S. & China relations deteriorate further after the U.S initiated a new critical export curb on Semi equipment items to China, in an effort to slowdown Beijing’s ability to develop more advanced technology infrastructure. This doesn’t only impact China, this also indirectly slows down global growth which will inadvertently later impact the U.S.

From an investment strategy perspective, if you hold Semis companies (AMD, NVDA, MU, LRCX, AMAT), Chinese Internet (KWEB, BABA, TCTZF, BIDU) or Chinese EV (NIO, XPENG, LI), it is critical that you understand the implications behind this curb and how it changes the business model of the companies just listed.

We wrote a strategy & analysis piece on this development this morning relating to how this development will potentially impact the business models of companies listed above along with portfolio positioning guidance. If you are a member/friend inside my Community, it should be delivered in your email inbox.

Although it may not feel like it at this moment, I wish to remind our Public and Private communities that real wealth is built during bear markets (a long, choppy, and unpleasant process). We are in a period of time where investors who deepen their learning in fundamental and macro analysis will emerge as more sophisticated investors once the Bear Market is completed. It is my mission to help inform, educate, and protect the Investors who learn from my research and strategy.

As U.S. & China geopolitical tensions rachet higher, investors who wish to locate their Chinese ADRs can do so on Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

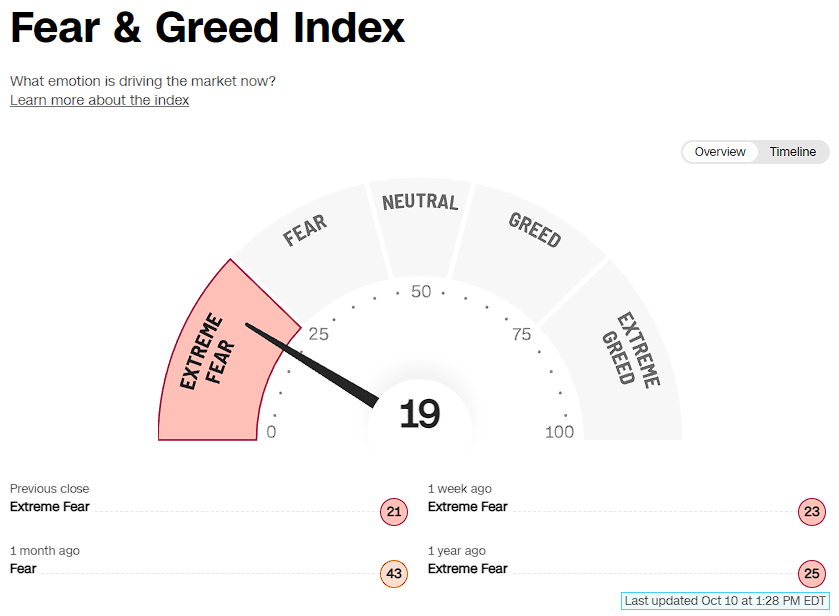

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index:

KWEB (Chinese Internet) ETF:

Analyst Team Note:

I came across a great article from Visual Capitalist discussing the effect of quantitative tightening on market volatility/liqudity. This year rates go higher and uncertainty is everywhere, a lack of buyers has led to tighter liquidity, leading to higher volatility. Definitely recommend checking out the article.

-Tim, Staff Analyst with Larry Cheung.

Macro Chart In Focus

Analyst Team Note:

Slower earnings growth could drive higher equity risk premiums (ERP) , which brings an interesting dilemma. If the risk-free rate (i.e. Treasuries) continue to rise, we could see market fall even more as ERP reprices higher.

Equity Risk Premium = Expected return of market Minus Risk-free rate

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

Two big things we’ll be watching this week is inflation (CPI and PPI) and big bank earnings.

While we believe we’ll see inflation stay elevated for longer, we’re hoping that CPI and PPI moderates for the month of September.

Banks including JPMorgan, Morgan Stanley, Citigroup, and Wells Fargo will be reporting earnings this Friday. We’ll be watching investment banking activity, refinancing demand, and other consumer loans as rates continue to rise.

Chart That Caught Our Eye

Analyst Team Note:

Over the past decade, low cost of borrowing drove up the share of less trustworthy borrowing. Almost a quarter of outstanding loans have a B- rating or lower. The debt-to-EBITDA of new loans have also jumped from ~4.5x - ~5.5x.

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs

If you haven’t yet seen Larry’s latest public strategy email, make sure to whitelist our emails in your Gmail, Hotmail, or Yahoo Mail.